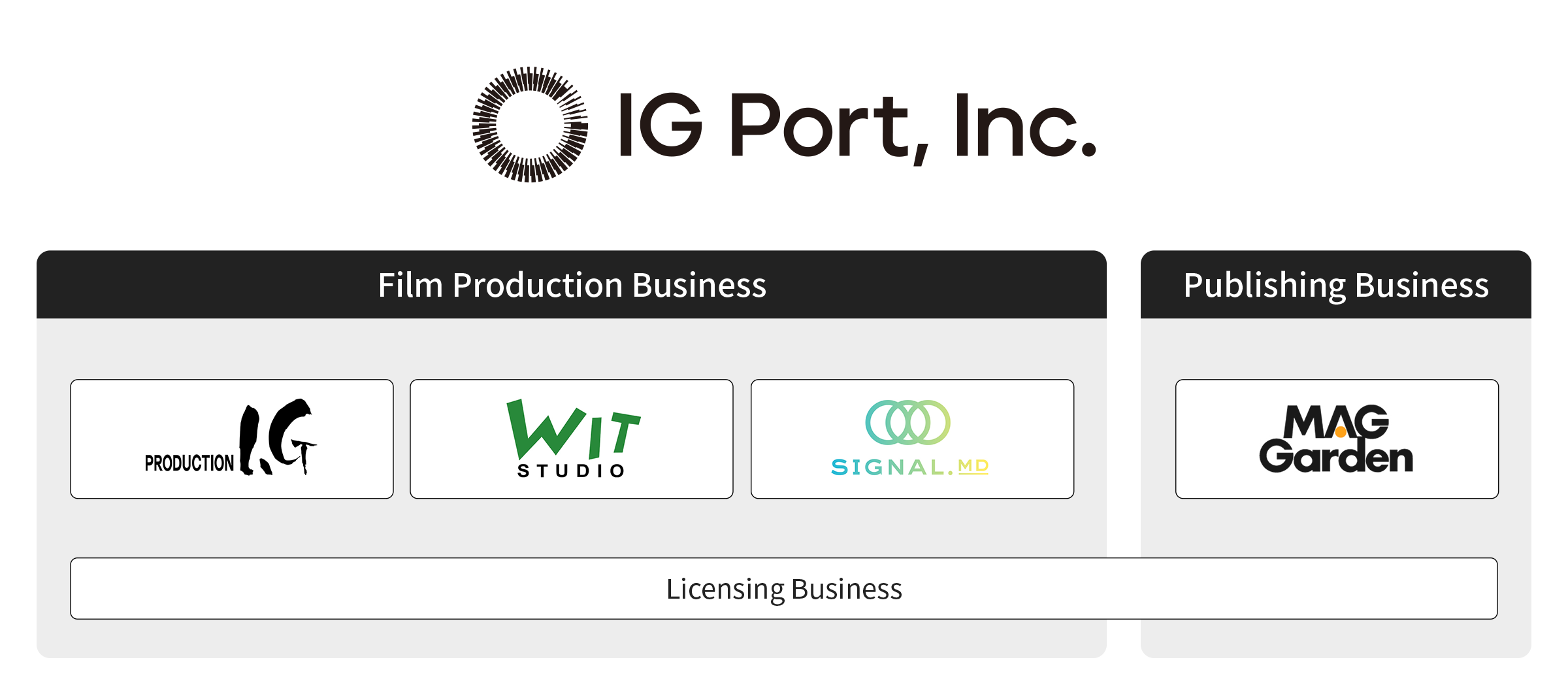

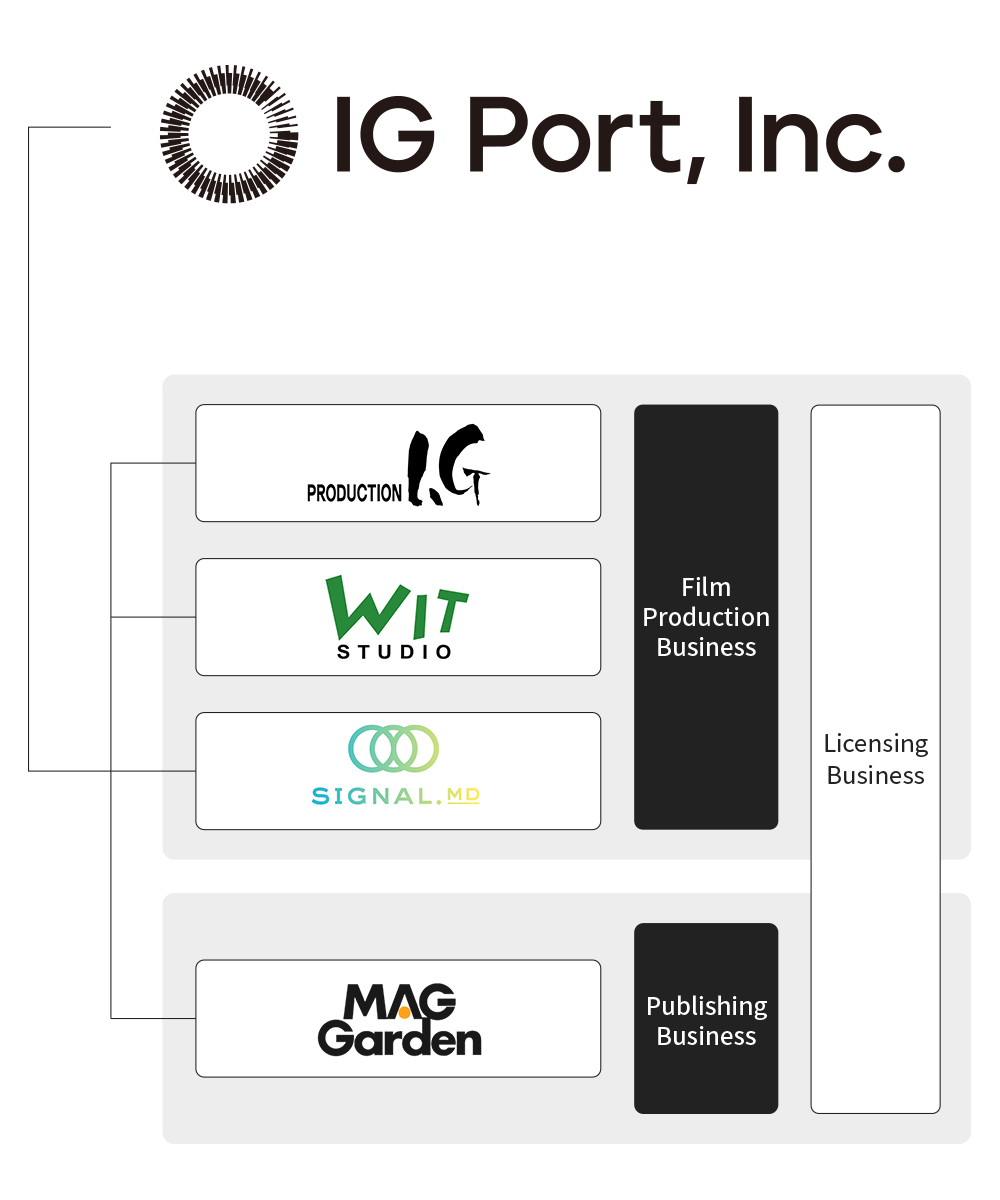

Our Business

The IG Port Group (the “Group”) consists of IG Port, Inc., the holding company, and its main consolidated subsidiaries (Production I.G., Inc., MAG Garden Corporation, WIT STUDIO, Inc., and SIGNAL.MD, Inc.). The Group’s primary businesses are the Film Production Business of animation and other media for theater, television, videogram, streaming, and game use, planning and publication of comics, and the Licensing Business for distribution of revenue from the secondary use of these works as well as for the earning of commissions from certain sales rights consultation operations.

Film Production Business

The Group is engaged in the Film Production Business of animation for theater, television, videogram, streaming, and game use as well as game software, based on orders received from domestic and overseas parties as well as its own original works.

The Group has an integrated production line from planning to editing. In addition to the video production capabilities of its creators, the producers and other management staff who manage the production line are working to improve their capabilities and accumulate expertise in areas such as maintaining quality standards, schedule management, and production budget management.

Business Characteristics

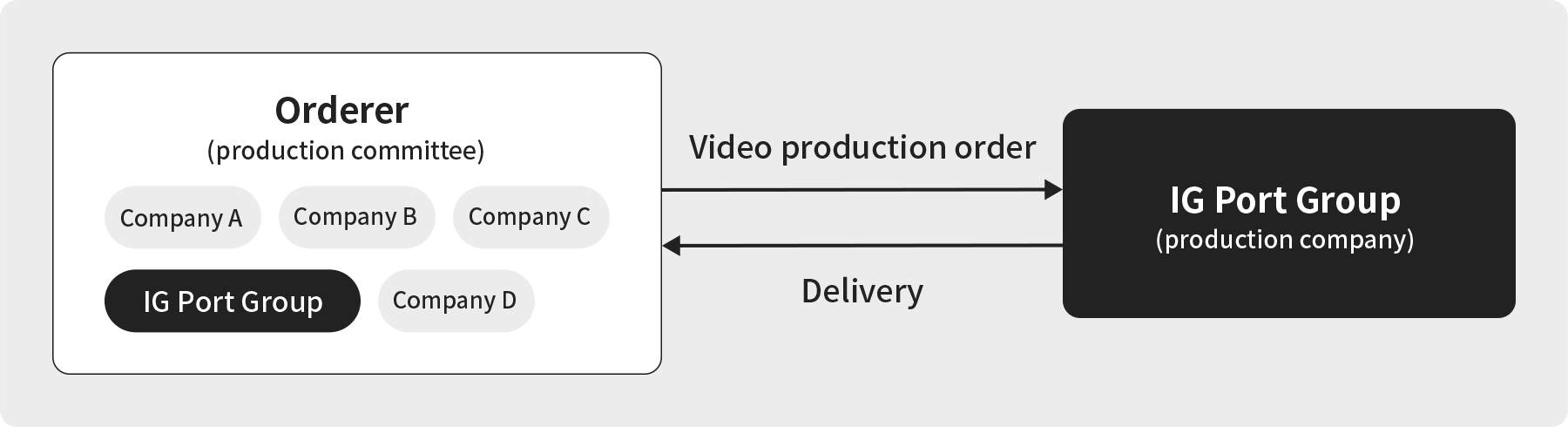

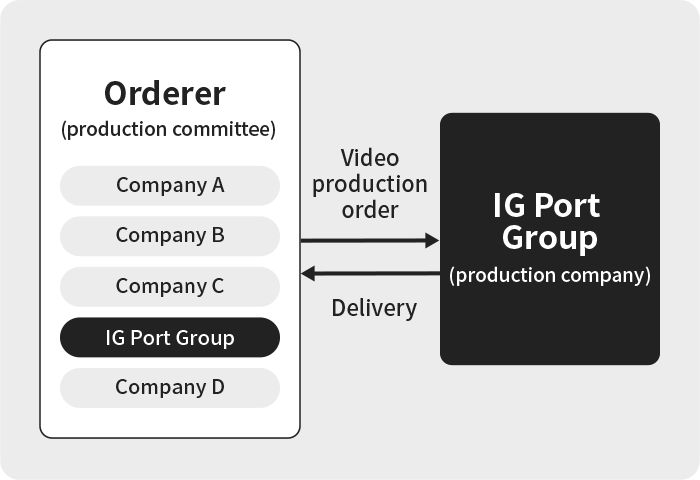

This business receives orders and delivers completed films.

However, orders are often received from the production committee of the film works, and the Group sometimes also invests in the production committee.

In such cases, the Group receives the order, but also has a partial presence in the party that places the order.

The gross profit of this business is the difference between the cost of the order and the film production.

- This business also undertakes simple subcontracting orders for film works.

- Operating profit by segment shown in financial statements is an amount obtained by deducting prorated corporate expenses from the gross profit.

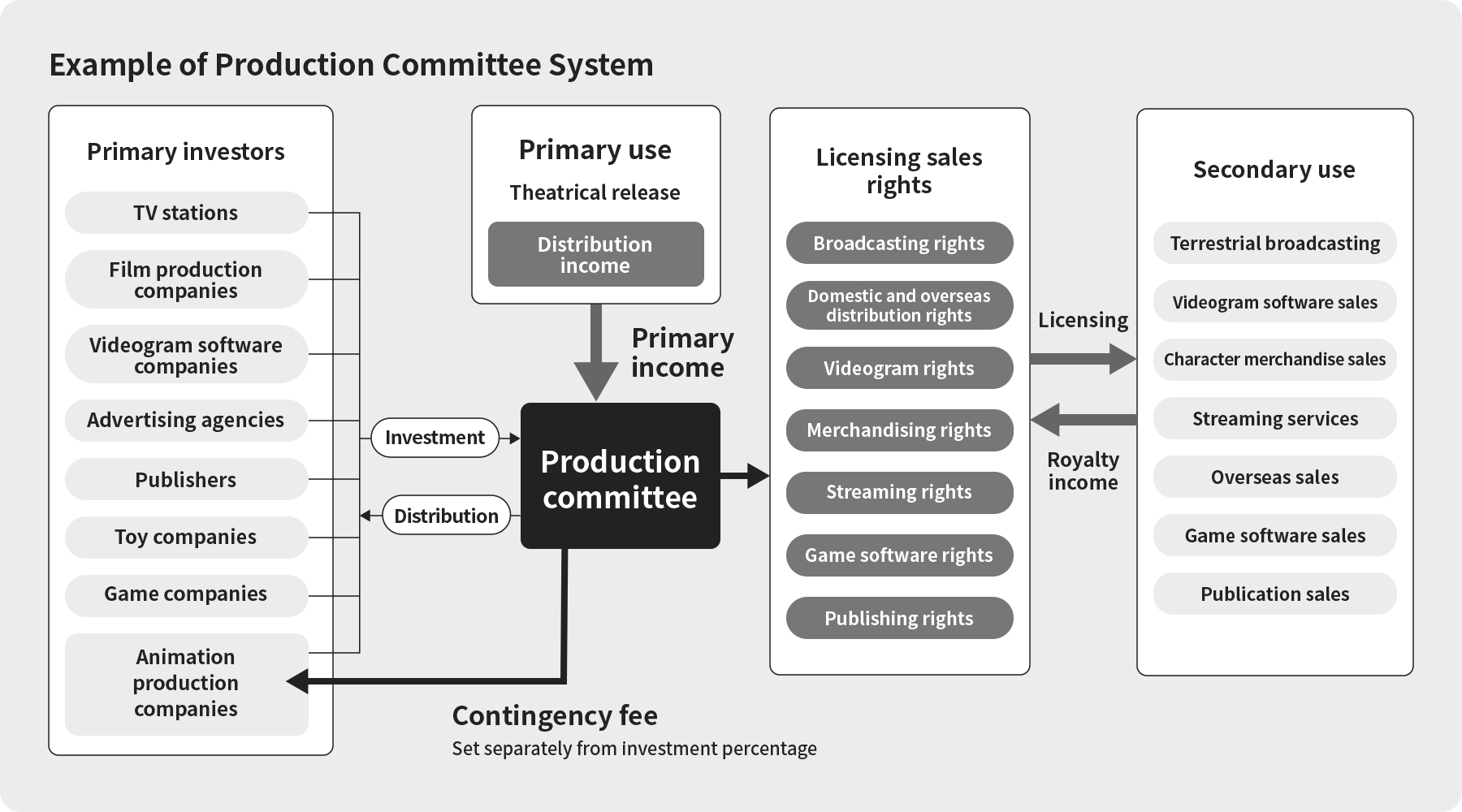

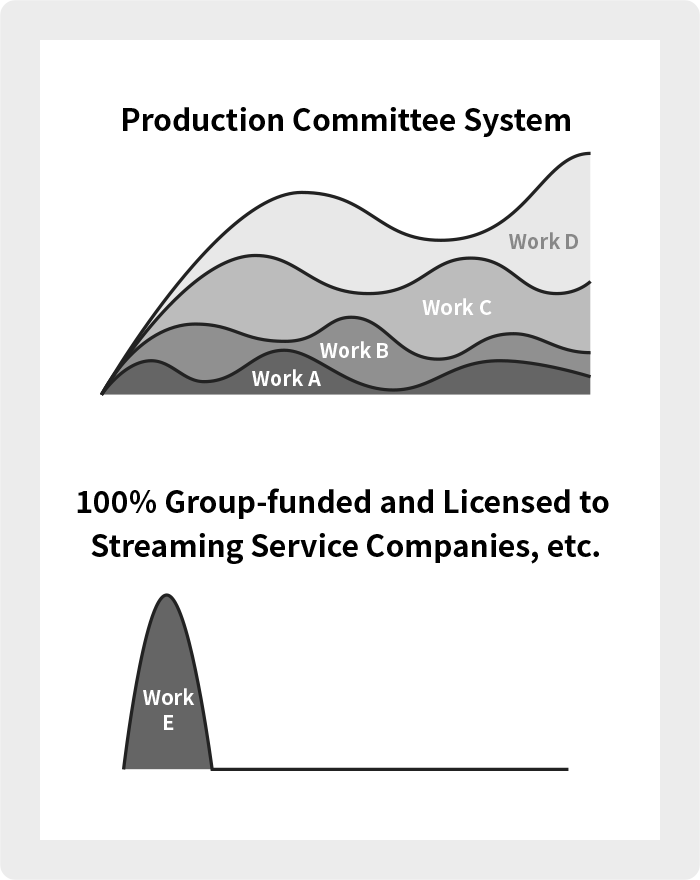

The production committee system is a system in which multiple companies jointly invest the funds necessary for production.

Licensing Business

The Group is engaged in the sale of some rights for the secondary use of works in Japan and overseas by investing in the production committees of film and other works.

Furthermore, the Group receives revenue sharing income proportionate to its investment percentage from such investment.

In addition, the Group receive production royalties (contingency fees) for works it produces, as well as royalties and other income such as planning and original rights for works it plans and originally creates.

MAG Garden Corporation utilizes the rights to use the original works of comics and earns licensing income from their secondary use.

Business Characteristics

1. Production Committee System

When a produced film work is used in various media, a prescribed royalty fee for the rights is generated and paid to the production committee.

The production committee distributes the funds to investors based on the percentage of their investment, after deducting the prescribed operating commission and allocation to the original creator.

In some cases, a separate contingency fee for the animation production company may be set.

The contingency fee is set based on negotiations between the production committee and the production company, and is not linked to the percentage of investment in the production committee.

Therefore, the amount of licensing income does not necessarily correspond to the percentage of investment in the production committee.

- Not all of these industries necessarily participate in the production committee.

The current trend is for a smaller number of companies to participate in the production committee.

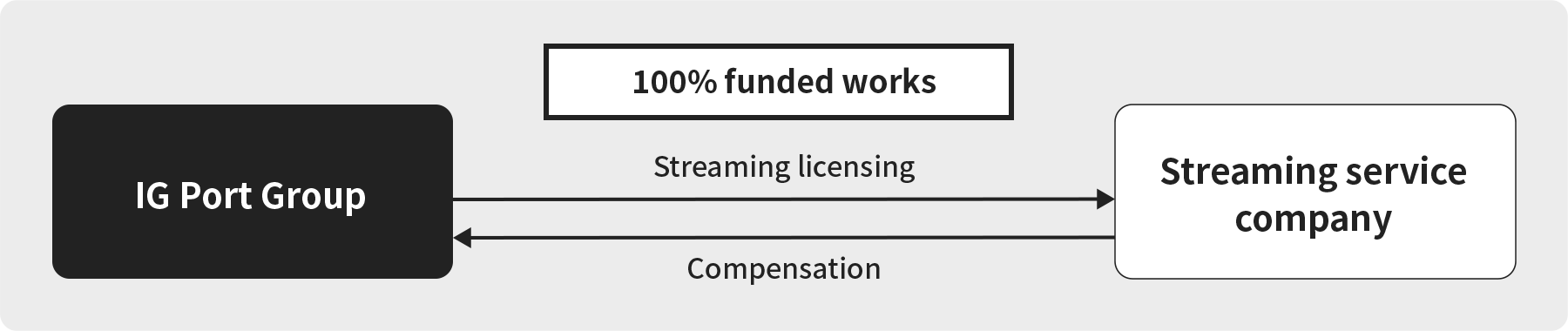

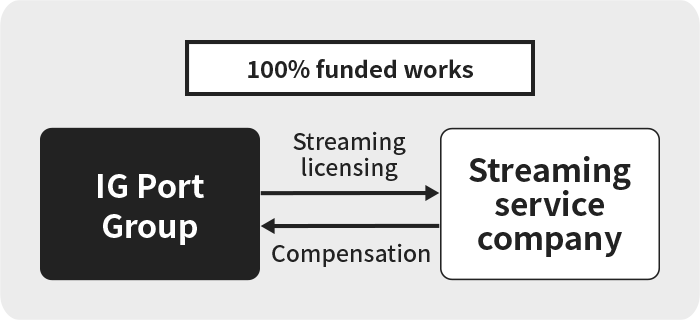

2. 100% Funding by the Group

The Group bears 100% of the production costs for production of animation.

The work is then licensed to streaming platforms and other companies overseas.

In such cases, sales are not recorded in the Film Production Business sales, and only the license amount is recorded as sales in the Licensing Business.

The gross profit is the difference between the cost of the video production and the streaming license fee.

- Although not numerous, these types of 100% Group-funded works exist.

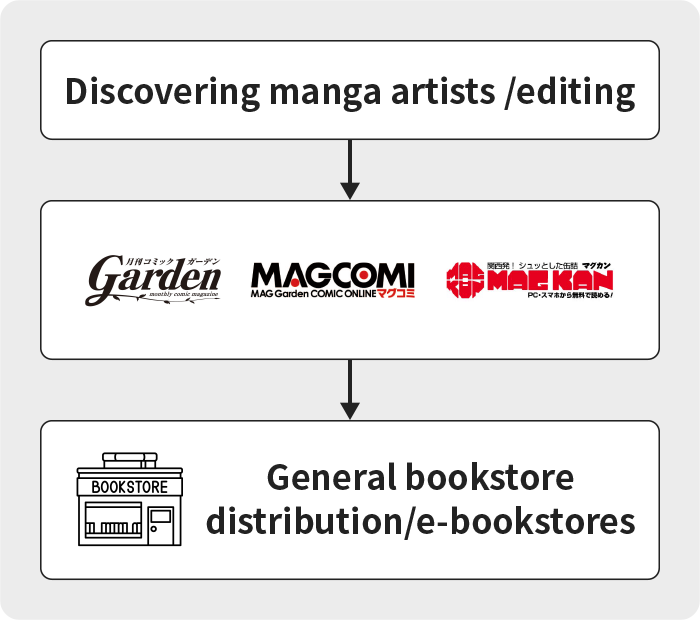

Publishing Business

The Group publishes and sells comic issues (magazines and periodicals), comic volumes (books) and related books such as illustrated collections, and e-books.

Business Characteristics

Editors belonging to the Group discover and provide editing services to manga artists and serialize their works in monthly manga magazines (Monthly Comic Garden) and on e-book websites (MAGCOMI, MAG KAN).

After publication, the work is published as a comic and sold through general bookstores and e-bookstores.

Sales to e-bookstores have grown significantly in recent years, especially in popular genres.

Paper books become sales once they are shipped (delivered to the publishing and sales companies).

Since paper books are products subject to the resale system, bookstores are free to return them.

As a result, provision for sales returns is recorded in each quarter.

E-books have the advantage of reduced costs associated with shipping, warehousing, and disposal as there are no returns from bookstores and no risk of overstocking, missed sales, or running out of stock.

Other Businesses

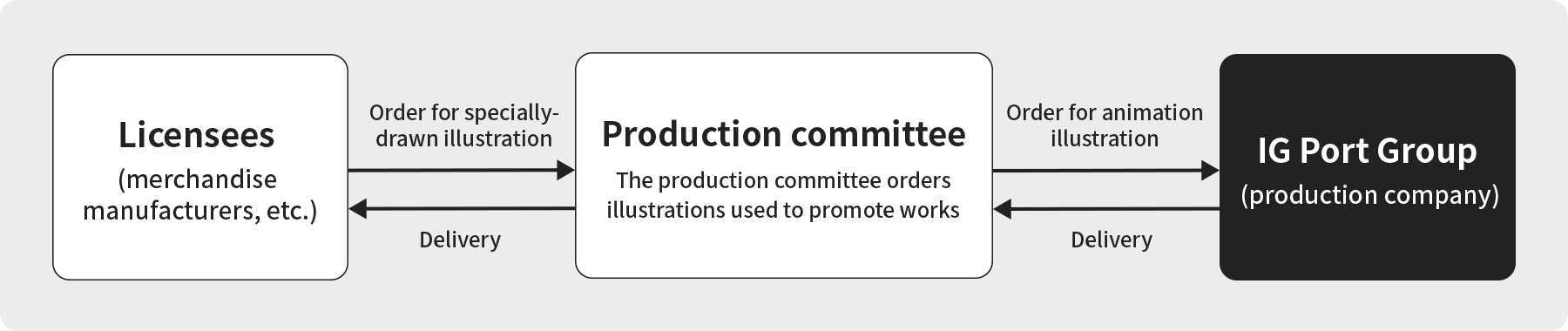

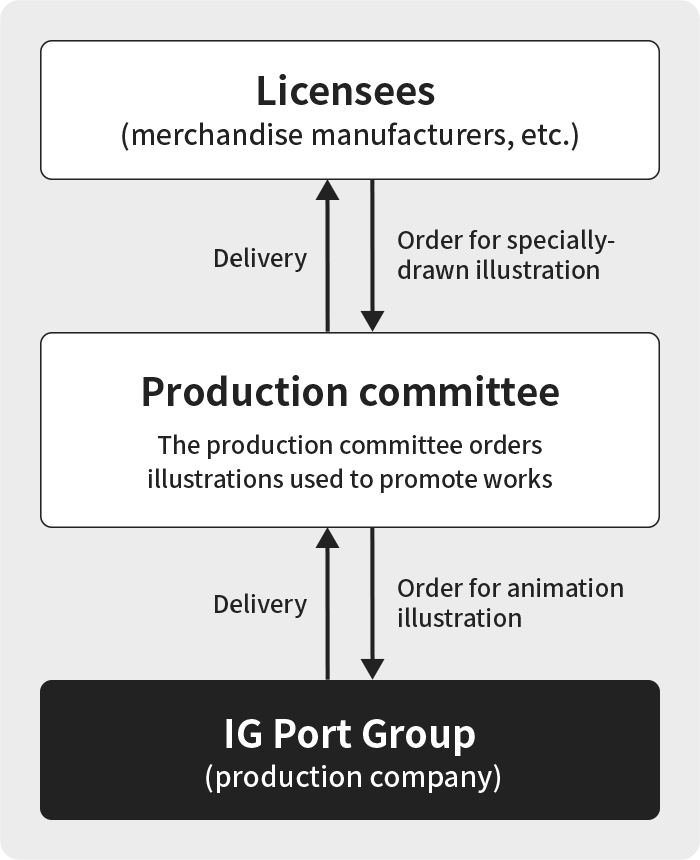

The Group earns income from illustrations used in magazines and products.

The Group also plans, manufactures, and sells merchandise for animations it produces.

Business Characteristics

The Group receives orders for illustration production primarily related to animation, and delivers them for compensation.

The majority of the illustrations are used for products or sales promotions.

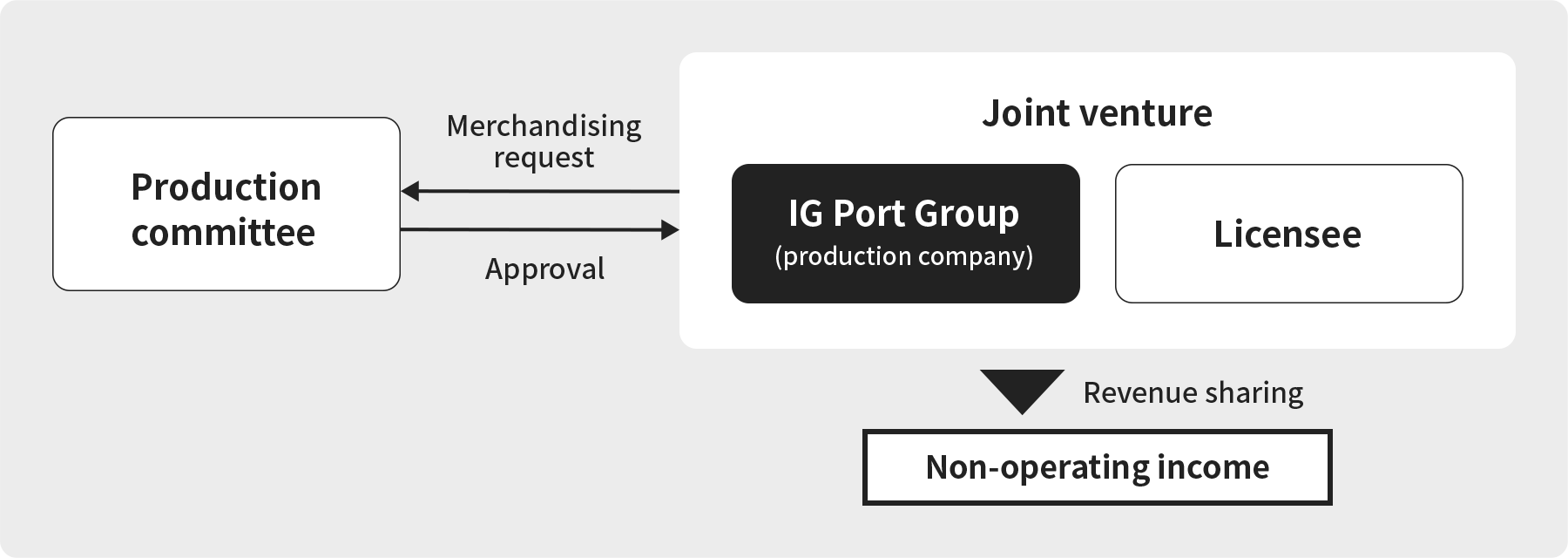

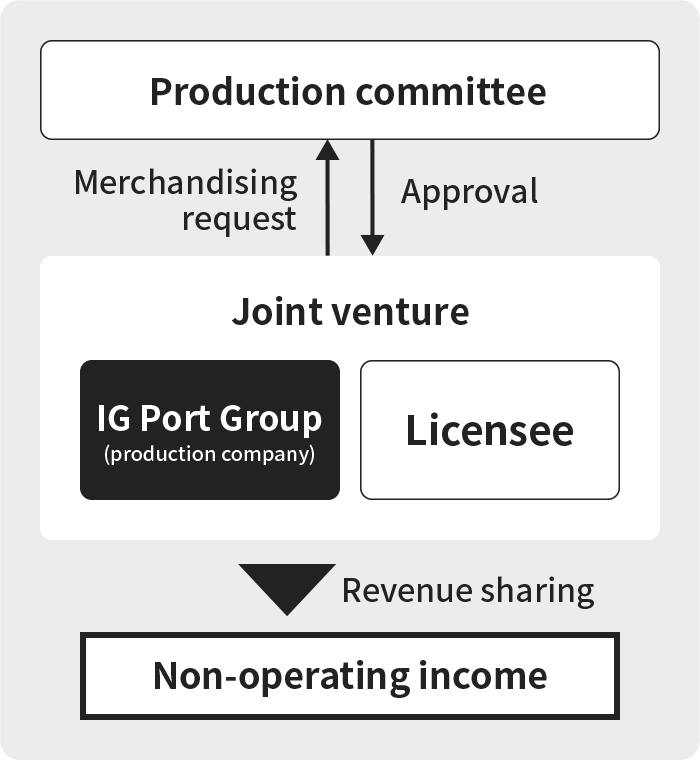

The Group plans, manufactures, and sells animation merchandise related to animations it produces.

It is currently a joint venture with another company, and revenue is recorded in the form of revenue sharing, not as the sales of merchandise themselves.

Accounting Characteristics

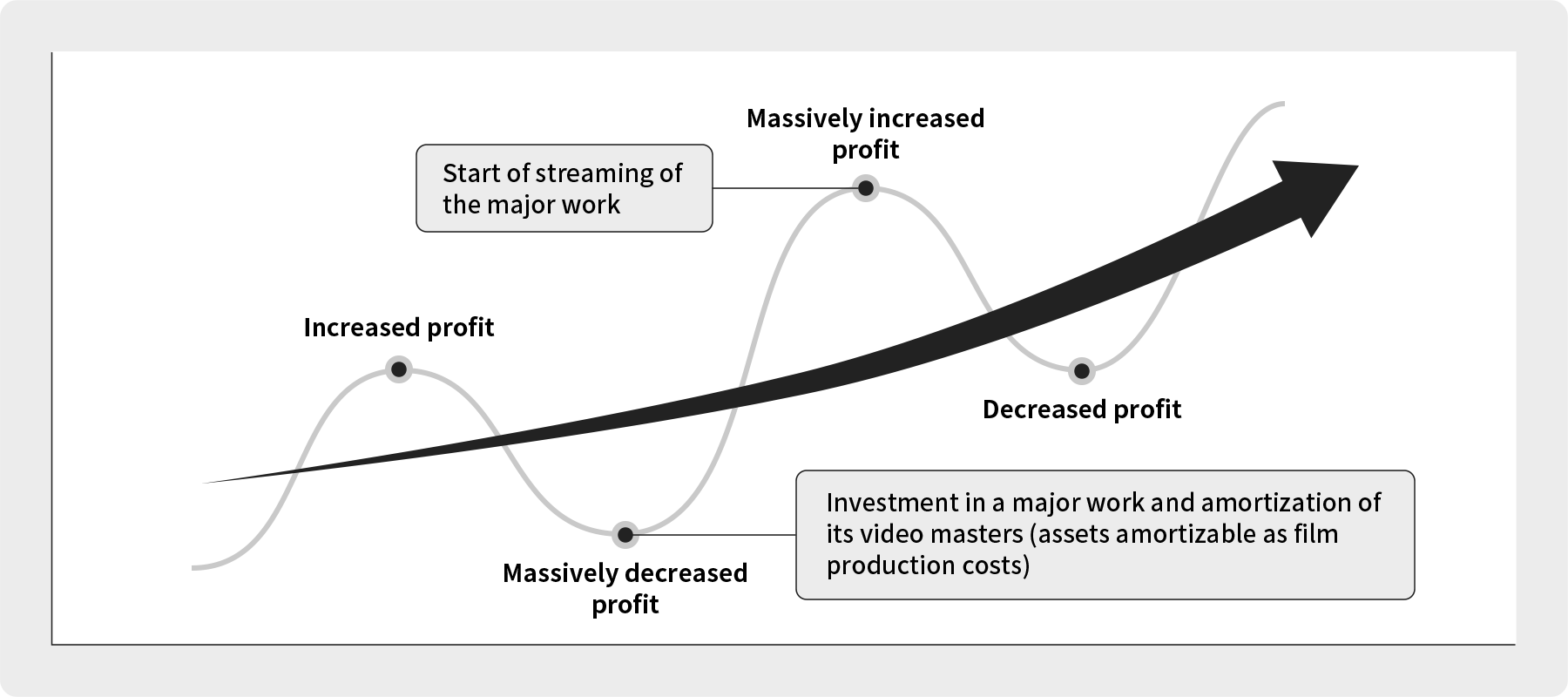

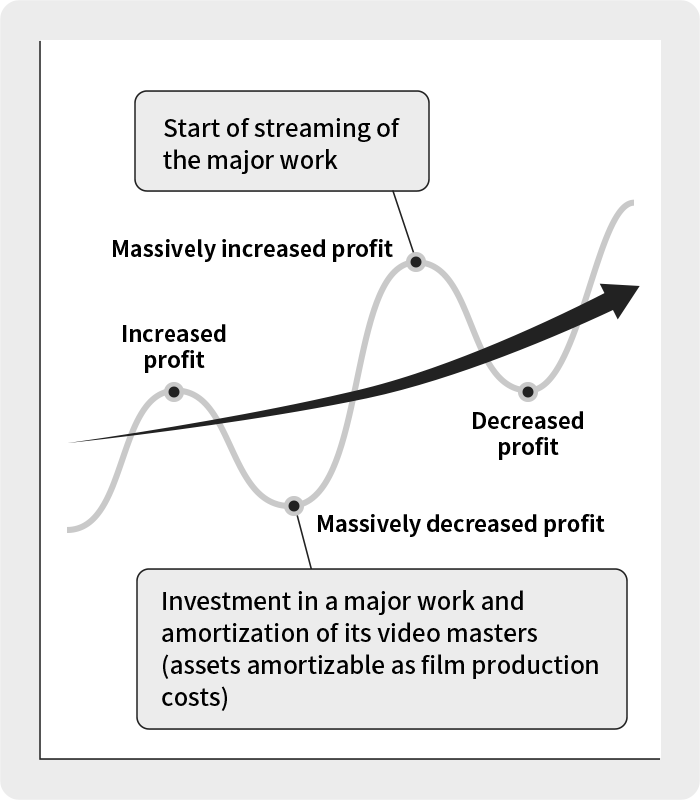

Due to the nature of the Group’s business model, the sales of each work in the Film Production Business and Licensing Business segments tend to be substantial.

As a result, the Group’s accounting has a characteristic in which the timing of the recording of sales depends on factors such as, the order and the production timeline of a work, and whether a work becomes a hit or not, and this variability significantly influences the Group’s performance.

Thus, performance tends to show significant upswings and downswings when viewed against each period.

Film Production Business

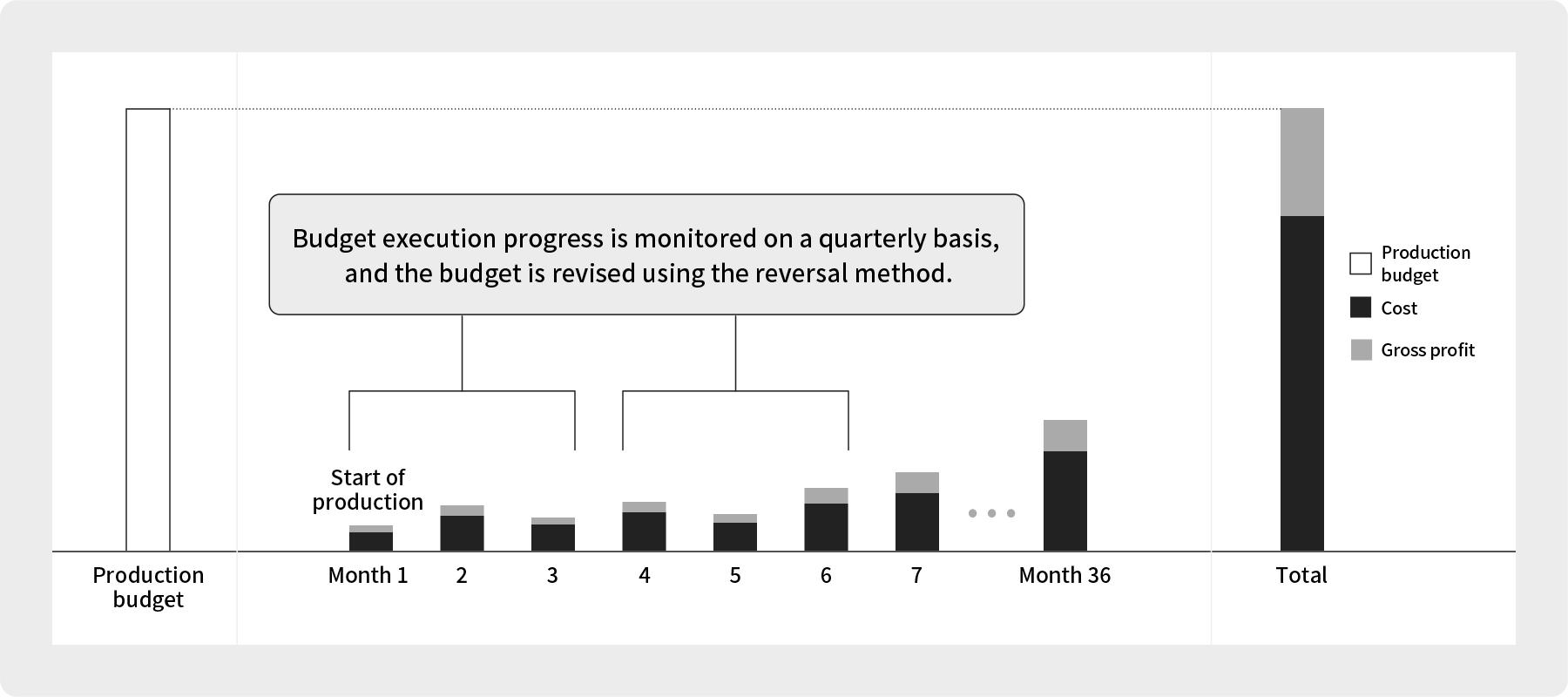

Sales in the Film Production Business are recorded on a percentage-of-completion basis, with the cost of the relevant works incurred each month plus an estimated gross profit.

Gross profit is obtained by multiplying the estimated gross profit margin rate using initial video production budget table data.

Since budgets often fluctuate over the course of the production of film works, the budget execution progress of each work is reviewed on a quarterly basis, and an allowance for loss on orders received is recorded for those deemed to be at a loss.

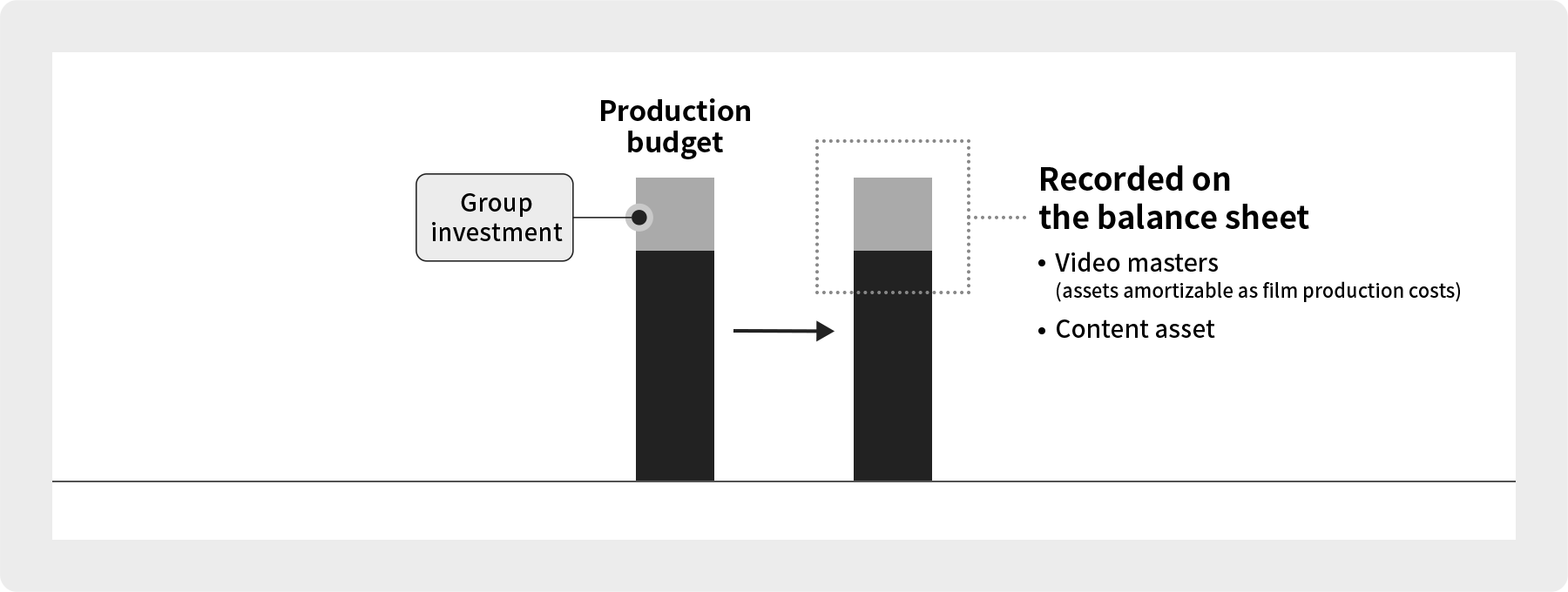

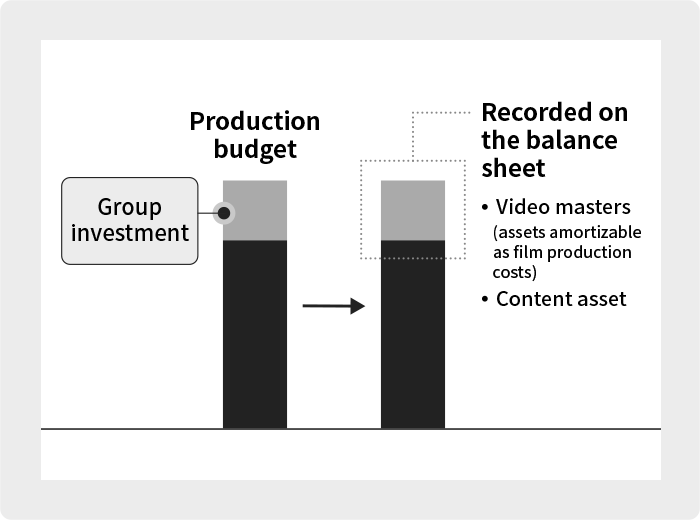

Recording of Production Income

The Group’s investment in the film production orders it receives is also recorded as sales.

The Group’s investment is capitalized on the balance sheet after delivery*1 and expensed through the prescribed depreciation.

- In some cases, assets may be formed as a suspense account even before delivery of the work. As a general rule, the amount is recorded in the accounts based on the following investment percentages.

Group investment percentage of less than 100%: Video masters (assets amortizable as film production costs)

Group investment percentage of 100%: Content asset

- However, it may be recorded as a content asset even if the investment percentage is less than 100% in cases where the Group lead the production committee as the organizing company, etc.

Licensing Busines

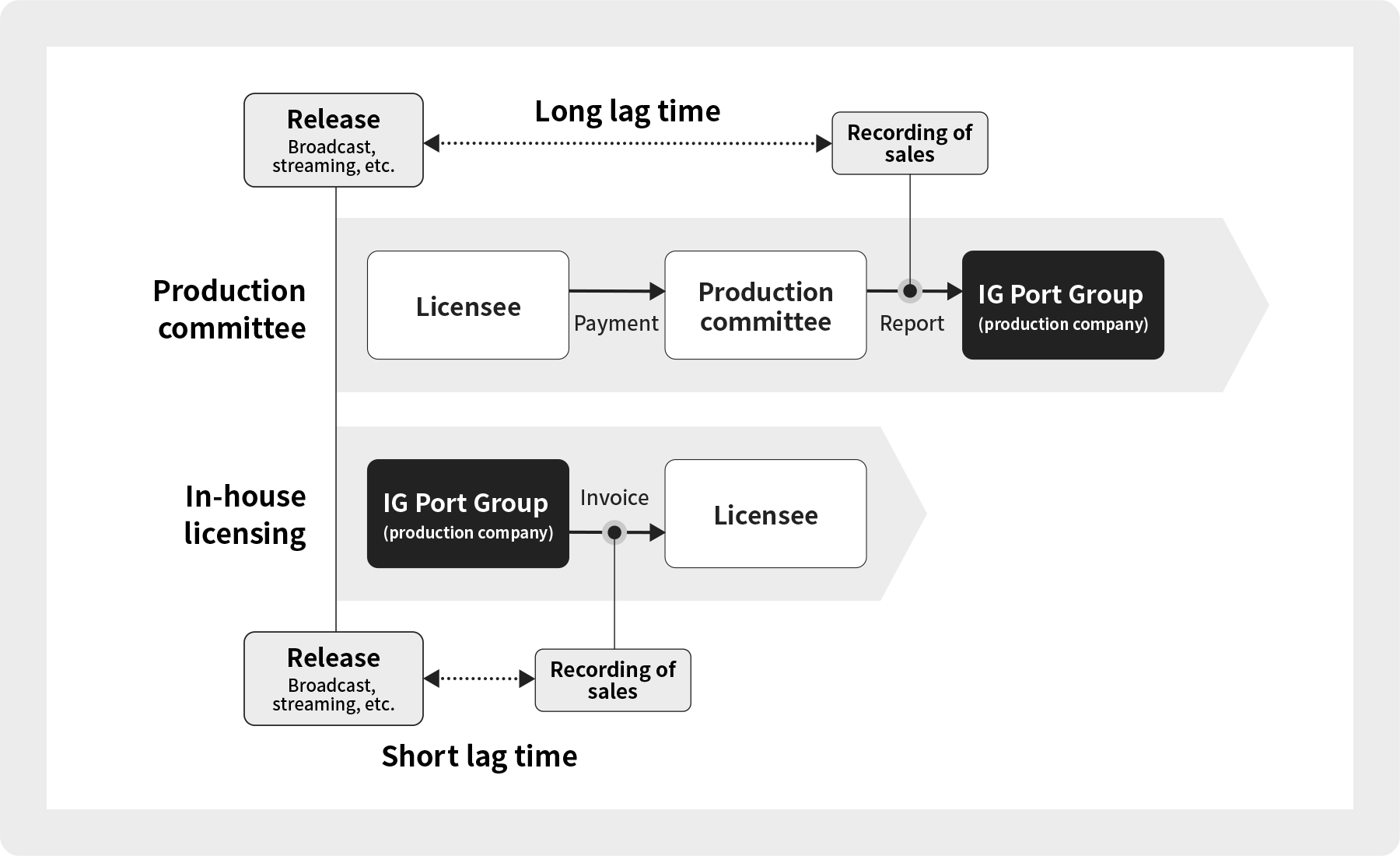

License Sales by Production Committee Partner

Sales are recorded when revenue is reported by the production committee’s organizing company (organizer). (Reporting standards)

License Sales by Group Subsidiary

Sales are recorded at the time of contract and invoicing to the licensee by the Group’s subsidiaries.

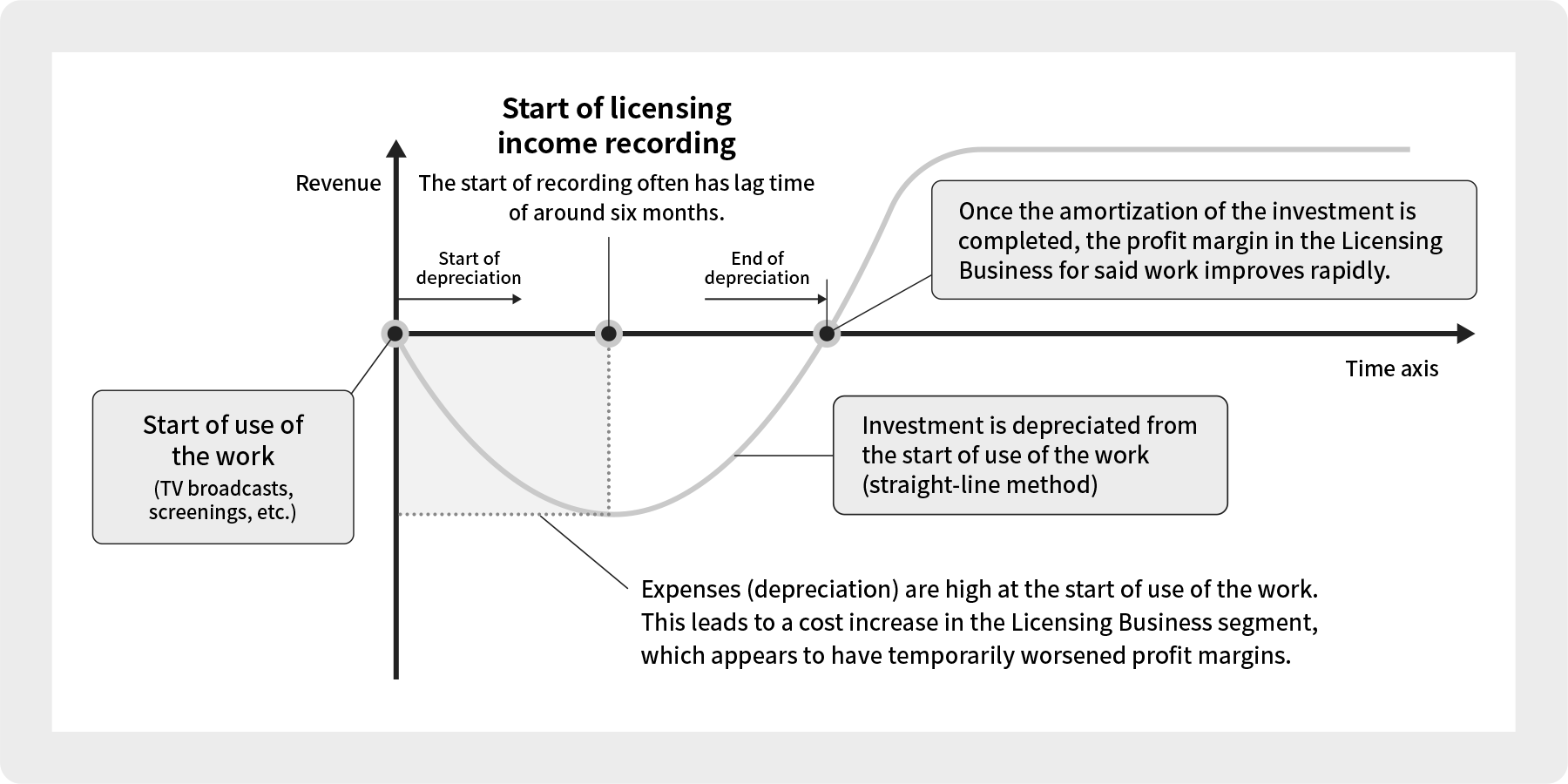

Due to the above characteristics, when a production committee partner conducts license sales, there may be lag time between the start of use of the work and the recording of licensing income.

As such, revenue from the Licensing Business for these types of works tend to be preceded by investment depreciation.

- Explained in “Timeline and Revenue Structure of the Licensing Business Segment” below

Timeline and Revenue Structure of the Licensing Business Segment

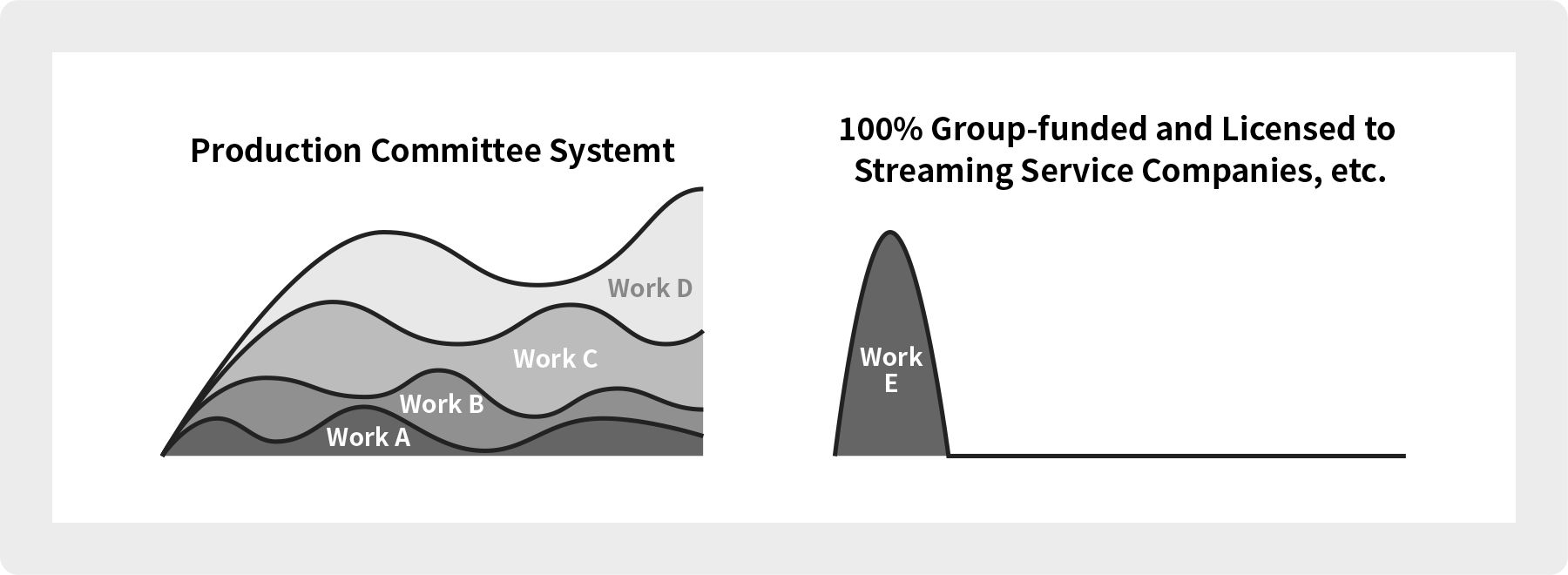

In the production committee system, licensing income tends to form a band-like revenue stream over a long period of time.

For 100% Group-funded works, there tends to be a large lump-sum of licensing income which does not accrue thereafter.

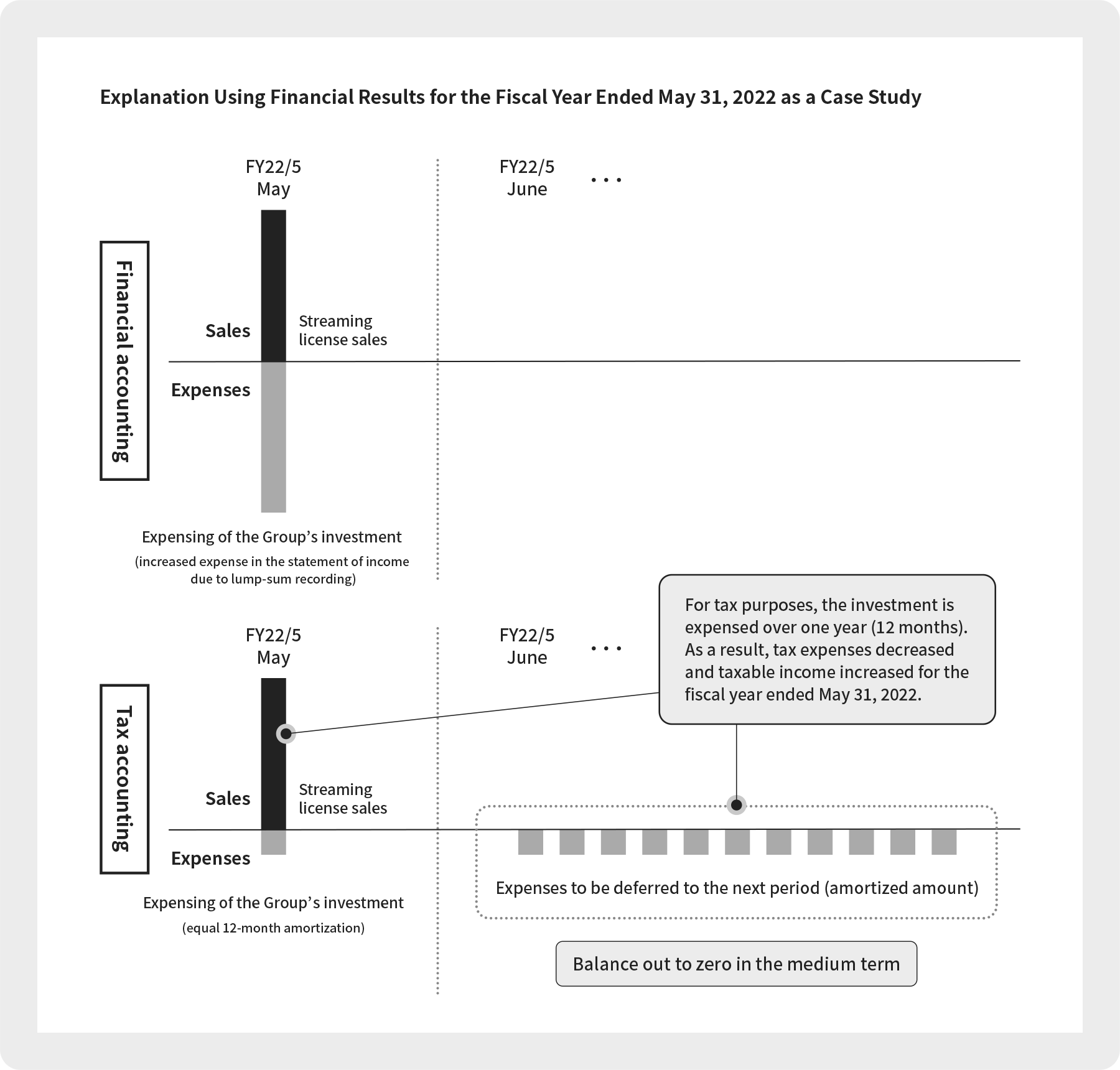

Tax Treatment of Licensing Business

For 100% Group-funded works, the license amount is recorded as lump-sum revenue for the entire amount stated in the contract.

(Recorded regardless of whether or not payment is received.) The costs incurred in video production of said work are also depreciated in a lump sum.

However, in tax accounting, the investment contribution is amortized over a 12-month period, which causes a discrepancy with financial accounting.

This results in a temporary increase in tax expense.

Since said tax expense will decrease in the following fiscal year and beyond, the overall tax expense for said work will balance out to zero in the medium to long term.

The above trends may result in significant changes in tax rates for each fiscal year.

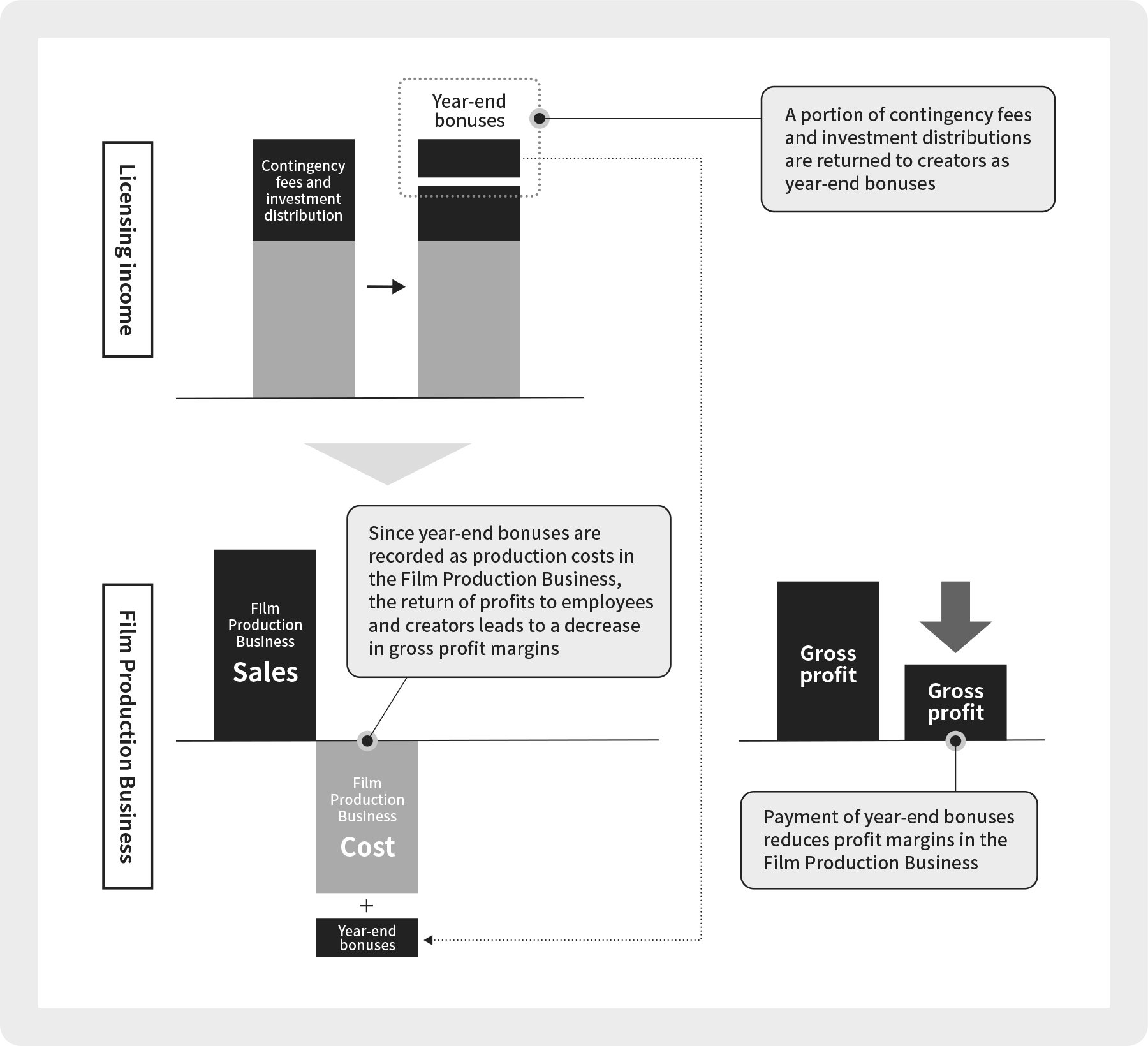

Return of Profits from Successful Works to Employees and Creators

It is the Group’s policy to return a portion of the revenue from successful works to employees and creators.

When a work is successful, revenue is recorded as licensing income (contingency fees and investment distributions).

This return is paid as year-end bonuses and recorded as a cost of the Film Production Business.

As a result, the profit margin of the Film Production Business tends to decline because year-end bonuses increase when a work is successful.

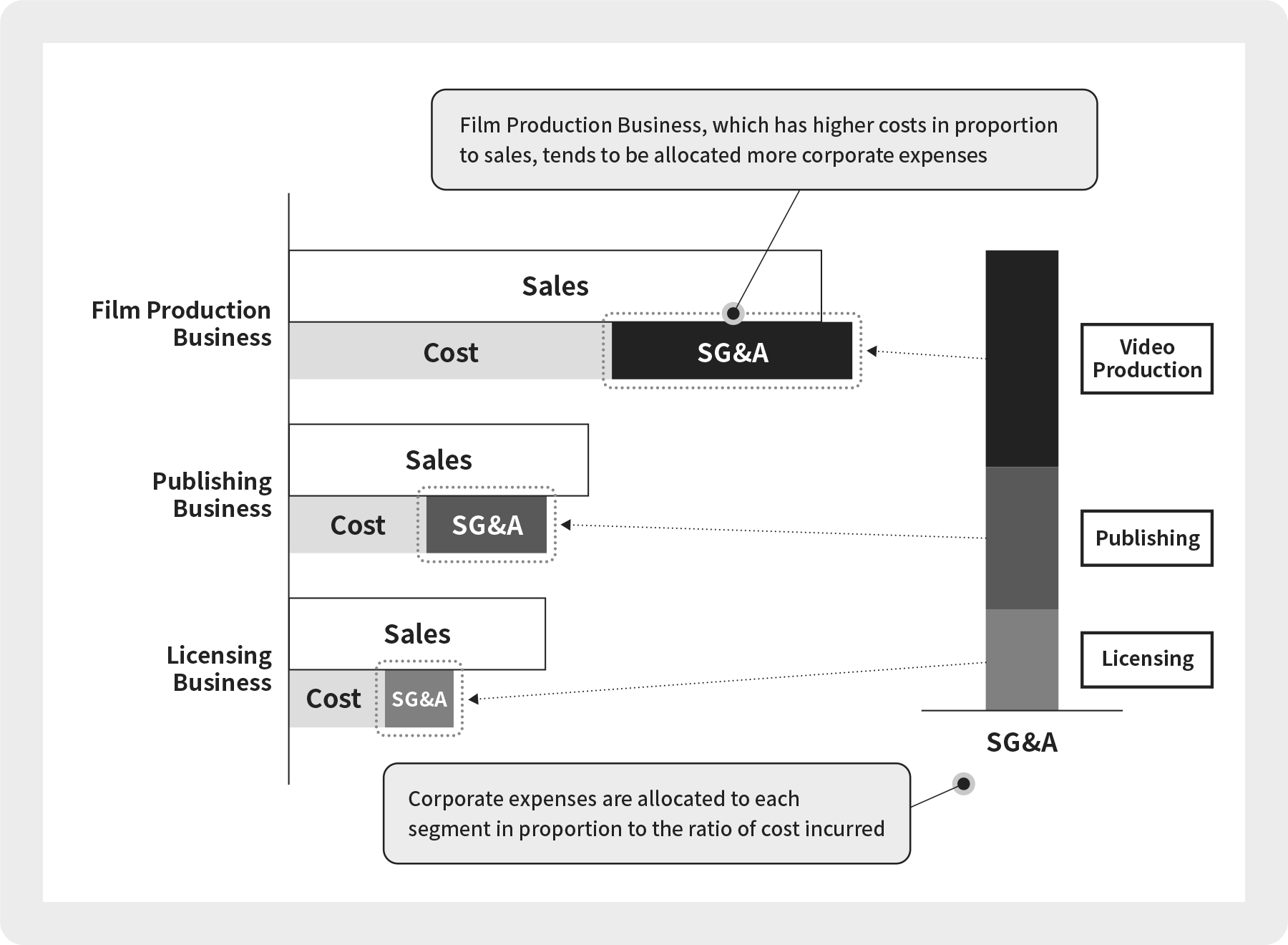

Supplement on Operating Profit by Segment

Segment information in the financial statements is calculated by allocating corporate expenses to each segment and calculating operating profit.

Since the allocated amount is calculated according to the ratio of cost incurred by segment, the amount of corporate expenses allocated tends to be higher for the Film Production Business, which has higher costs in proportion to sales.

As a result, profit margins in the Film Production Business tend to be lower.

Organizational Structure